An introduction to PTFE Pricing

Being a niche industry, PTFE doesn’t exactly get a lot of press even when large shock waves surge through it, disrupting the operations of manufacturers and end-users alike.

In 2010-11, the price of virgin PTFE began climbing, after having dipped consistently over the preceding 5 years. What started out as an understandable correction soon turned into an all-out crisis, as the price nearly quintupled over the next 8-10 months.

Imagine that scenario in any other industry. If the steel price to see a 5x increase in less than a year, what horrors would that unleash into the broader market? That the PTFE industry survived is a testament to the incredible properties of the material, that makes it so difficult to substitute using other polymers such as PVC. Both PVC & PTFE are thermoplastics and The PVC prices are much lesser compared to PTFE.

To make matters worse, since the industry is small, there was no one to really make sense of the economic factors driving the price increases.

We stepped in at that time, partly driven by our own need to analyze the situation, but also because the information we collected seemed like it would be useful to other industry players.

Many articles were released between 2011 and 2013 that charted the various drivers of PTFE pricing and made sense of the driver that would play out going forward.

April 2011 – What’s the matter with PTFE prices?

May 2011 – The mysterious relationship between Fluorspar and PTFE prices

August 2011 – Mapping the PTFE Price Increase

December 2011 – PTFE Pricing Again – is there another price hike in the offing?

March 2012 – PTFE Prices – taking a step back to leap forward?

February 2013 – Mapping the PTFE Price Increase – An Update

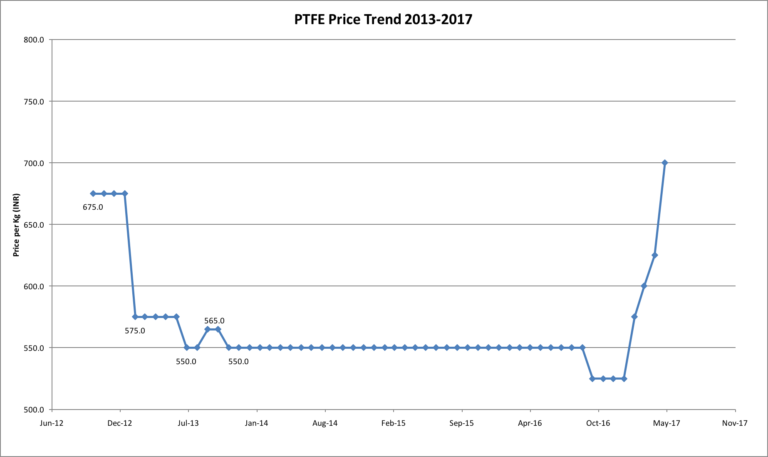

Over the past few months, there have been murmurs of a return to the high pricing seen in 2011. Resin suppliers have offered ample warning that a price revision was imminent. So far, this has translated into 2 price corrections to the extent of 10-15% and 8-10% in the months of April and May respectively.

We need to compare this with the escalations seen in 2011-12 and understand that the rise is not quite so sharp. Nonetheless, we also need to compare the cost drivers and ensure that the same pattern is not repeating.

Key Drivers of PTFE Price

Unlike other polymers – such as polythene, polypropylene, and polycarbonates, PTFE does not result as a by-product of the oil refining process. This comes as a shock to many, who assume that our fates are tied to oil prices and that we should, therefore, be benchmarking our final rates accordingly.

PTFE is made from the polymerization of R22 gas – a refrigerant that finds its use mainly in the air conditioning and refrigerator industries. As a result, PTFE prices are driven by the demand and supply of R22. Many OEMs are working really hard to make sure R22 is available at competitive prices.

When prices started increasing in 2011, the key driver was thought to be Fluorspar – a mineral that is critical to the manufacture of R22. In conjunction with this, a spike in demand from the AC and refrigerator markets in China along with a general crackdown on R22 usage (as it is not an environmentally friendly gas) caused prices to shoot up.

Today, the scenario is slightly different.

For one – we’re over halfway through the summer, so we’re not likely to see any shocks due to AC and refrigerator demand. Furthermore, Fluorspar supply has also regularised. A key effect of the price increase in 2011 was that idle Fluorspar mines in South Africa were reopened, offering an easing of supply to the market that was otherwise dominated by China.

If industry insiders are to be believed, the key driver this time around is environmental. China has been actively seeking to clamp down on R22 usage and has, in the process, shut down two PTFE plants that were not adhering to the standards. It is from here than the supply constraint has originated, driving up PTFE raw material prices within China. Obviously, as the China price is usually the floor price for most goods in the world, this has allowed resin manufacturers around the world to increase rates accordingly.

Where the prices go from here depend on three factors:

- Whether the shut-down plants will be coming back on line after making the necessary changes. It is yet unclear if the plants have been permanently shut down or are only undergoing an overhaul to make them compliant with the environmental codes. If they do come back online within the next 6-8 months, we would see a return to lower prices

- Whether the move to phase out R22 will go as scheduled R22 is being phased out not only in China, but all over the world. India has also committed to stop using the gas completely by 2032. If this phase-out continues, it could result in a supply surplus to the PTFE industry, driving down prices. However, if the use of R22 in PTFE is itself restricted, then it would require a shift to alternatives of R22, which would be expensive. Currently, as there is no talk of restricting R22 in PTFE specifically, it is likely that the former would result

- Price inelasticity of PTFE In 2011, one thing that was made clear was that even at 5x multiples, there was still demand for PTFE resins. This allowed the resin manufacturers to continue increasing prices well above the rates that would have resulted from purely economic factors.

Commodity resins are often inexpensive and easy to process plastics. They are used in all kinds of applications, including toys, packaging, and consumer products.

Ultimately, it was due to competition from China that forced prices back to normal levels.

In the short term, it is likely that resin suppliers will again try and test the market to see what levels they can sustain at. With the threat of China temporality removed, it remains to be seen how far they will push the market.

We only have snippets of information at this point to make sense of the situation. Clearly, with PTFE being used in so many fields, this poses some concern to many industries. We will be keeping our ears to the ground to see if anything else come up.